what does a stock being oversold mean

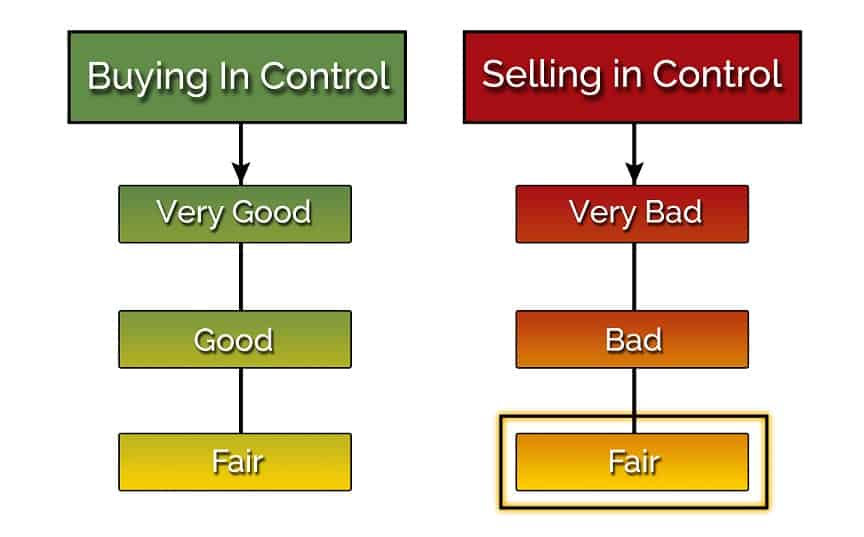

An oversold market is one that has fallen sharply and is expected to bounce higher. If a stock is oversold it means that the number of sellers outweighs the number of buyers.

Overbought Vs Oversold And What This Means For Traders

On the other hand an overbought market has risen sharply and is possibly ripe for a.

. An oversold stock has a current price the viewer thinks is lower than the inherent value of the stock. Oversold is the condition that occurs when a stock has dropped in price and the supply driving the price down has dried up. That means they expect the price of the stock to go up at some point in.

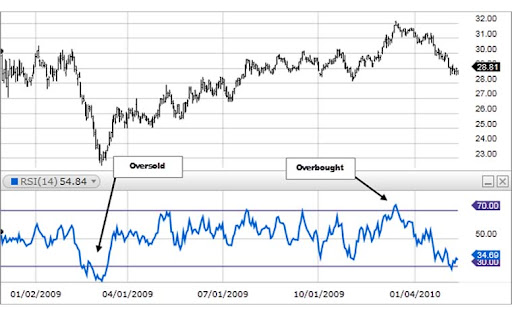

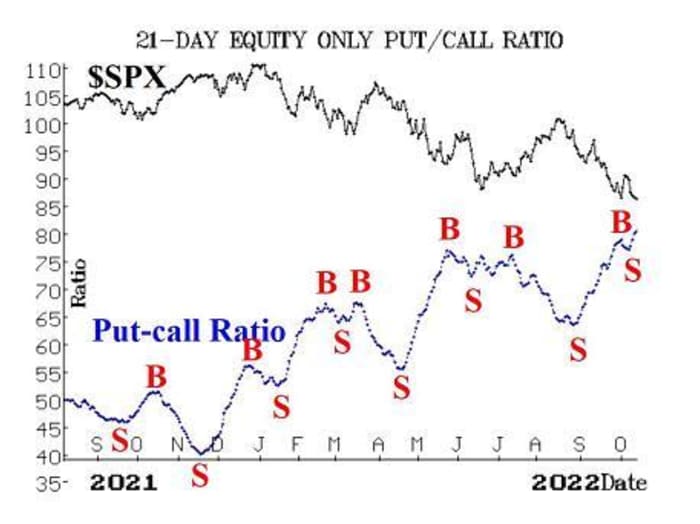

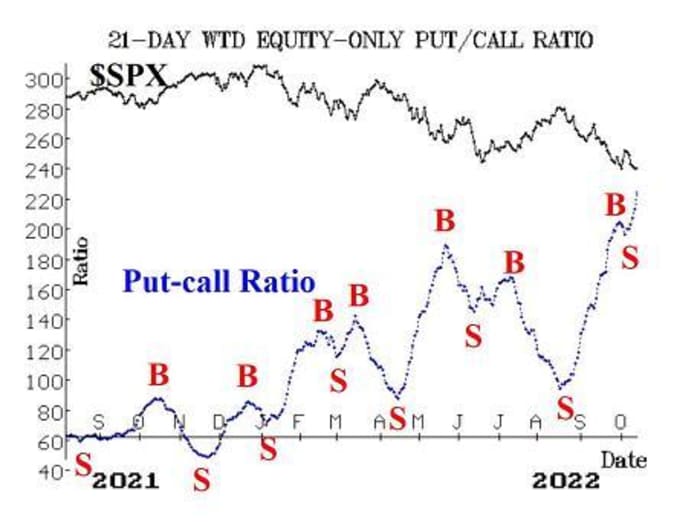

However if you see a stock that is showing signs of being oversold on multiple indicators it may be worth taking a closer look. Many technical analysts use what is called stock oscillators such as Stochastic. An oversold stock means that a companys shares are currently under heavy selling pressure but have the potential to bounce back.

Oversold means the stock price has taken a nosedive and theoretically selling pressures have exhausted and people may be willing to start buying it again driving the price. What Does Stock Oversold Mean. Oversold means the stock price has taken a nosedive and theoretically selling pressures have exhausted and people may be willing to start buying it again driving the price.

The thing is this potential can last for a very long time. While the sell-off has caused its share. An asset is said to be oversold when its price has fallen and there is a chance that it will rise again.

If an analyst rates a stock as overweight they think that the stock will perform well in the future. Can a stock become oversold multiple times. Of relating to or being a stock market that has declined rapidly and steeply in the recent past and is likely to exhibit short-term price increases in the near future.

A big company might be about to release bad news. Being oversold doesnt guarantee. At its most basic oversold stocks refer to stocks that have been selling for a lower price and have potential to bounce back in value.

It is a market environment where all analysis reports sentiment and indicators point towards a stock being priced below its actual market price. When you see an asset continuously sold on the market it means that the asset has hit rock bottom. Oversold is a term used to describe a stock that has lost price value sharply and steeply.

This can happen for many reasons such as. Answer 1 of 5. They believe it is worth buying as it could outperform the broader market and.

Ultimately oversold stocks are undervalued. Tip When a security in the stock market is. An oversold asset is undervalued.

Answer 1 of 4.

Oversold Stocks Short Term Marketvolume Com

:max_bytes(150000):strip_icc()/154186232-5bfc2b9c46e0fb005144de15.jpg)

What Oversold Means For Stocks With Examples

The S P 500 Seems Dramatically Oversold Investing Com

4 Ways To Trade Oversold Levels What Does It Mean When A Stock Is Overbought

Stock Market Prediction S P 500 Oversold But It S Not Time To Buy Yet

What Is The Relative Strength Index Rsi In Stocks Nasdaq

How To Find Overbought Or Oversold Stocks Easy

Overbought Vs Oversold A Trader S Guide Ig International

4 Ways To Trade Oversold Levels What Does It Mean When A Stock Is Overbought

How To Use The Relative Strength Index Rsi Youtube

Relative Strength Index Definition Investing Com

We Got An Oversold Rally Now Let S Take Stock Of The Quarter Realmoney

How To Determine Overbought And Oversold Conditions And Trade Profitably Bullbull

Overbought Vs Oversold And What This Means For Traders

Most Oversold Stocks 2022 Rsi Undervalued Stocks

Market Outlook Price Action Is Bullish For Stocks But Macro Is Weakening Seeking Alpha

Opinion The Stock Market Is Oversold But It Pays To Stay Bearish Marketwatch

:max_bytes(150000):strip_icc()/dotdash_Final_Overbought_or_Oversold_v1_Use_the_Relative_Strength_Index_to_Find_Out_Oct_2020-02-038eda690acd41f6ae1bb2db77e94b86.jpg)

Rsi Indicator Buy And Sell Signals

Opinion The Stock Market Is Oversold But It Pays To Stay Bearish Marketwatch