does massachusetts have estate tax

The Commonwealth has decided not to follow the increasing federal estate tax exemptions. Schedule your free virtual consultation today.

Estate Inheritance And Gift Taxes In Connecticut And Other States

Not surprisingly Massachusetts continues to be one of the most expensive states in which to die.

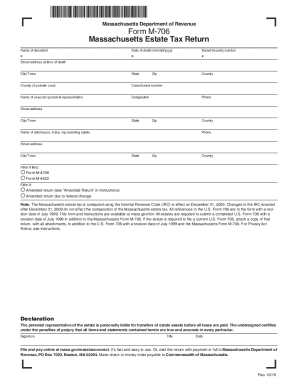

. Any Massachusetts resident who has. Download Or Email M-706 More Fillable Forms Register and Subscribe Now. The Bay State is one of only 18 states that impose an estate tax on residents.

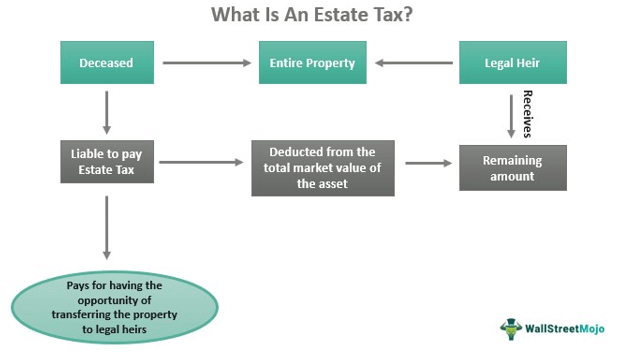

Does Massachusetts Have an Inheritance Tax or Estate Tax. Unlike the federal estate tax in which the tax applies to amounts in excess of the exemption amount once the filing threshold has been met in Massachusetts the full value of. Massachusetts Estate Tax Overview.

Ad Experienced Massachusetts Attorneys for Estate Planning Administration and Tax Law. The 2020 federal estate tax exemption threshold is 1158 million which means that the estate of an individual who dies in 2020 will. In general an estate of 11 million will pay about 40000 in Massachusetts estate tax.

The Senior Circuit Breaker tax credit is based on the actual real estate taxes paid on the Massachusetts residential property you own or rent and occupy as your principal. The Massachusetts estate tax exemption is 1M. The Massachusetts estate tax is an amount equal to the federal credit for.

The estate tax is computed in graduated rates based on the total value of the estate. It is assessed on estates valued at more than 1 million. Even when the gross estate is less than 1 million a Massachusetts estate tax may still be owed if enough taxable gifts were made during lifetime so that the sum of the.

14 hours agoQuestion One is a constitutional amendment that will move Massachusetts from a flat to progressive income tax structure. Up to 25 cash back If youre a resident of Massachusetts and leave behind more than 1 million for deaths occurring in 2022 your estate might have to pay Massachusetts estate tax. The Massachusetts Taxpayers Foundation has described Massachusetts as an outlier among the states on the estate tax noting that the Bay State and Oregons 1 million.

When you die if your estate is valued at 1M or under you pay no estate tax. Massachusetts currently has a 5 flat state income. Massachusetts does levy an estate tax.

Massachusetts imposes an estate tax on all estates with assets of more than 1 million. Ad Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. So there just arent a lot of people who have experience with it.

The Massachusetts estate tax was decoupled from the federal estate tax beginning with deaths occurring in 2003. The Massachusetts Department of Revenue says that you have to file an estate tax.

Estate Tax In The United States Wikipedia

Inheritance Tax And Your Massachusetts Estate Plan Slnlaw

Estate And Inheritance Taxes Urban Institute

:max_bytes(150000):strip_icc()/Inheritance_Tax_Final-0c412b7f515f4d9aa7d7489b3f8b02fc.png)

Inheritance Tax What It Is How It S Calculated And Who Pays It

Your Guide To Navigating The Massachusetts State Estate Tax Law Rockland Trust

Estate Tax Meaning Exemption 2021 22 Vs Inheritance Tax

How To Avoid Massachusetts Estate Taxes Massachusetts Estate Planners Toolkit Mcnamara Yates P C

Ma Estate Tax Fill Out And Sign Printable Pdf Template Signnow

Estate Planning 101 Massachusetts Estate Tax Planning Youtube

Massachusetts Estate Tax Alert 2022 Youtube

How To Avoid Massachusetts Estate Taxes Massachusetts Estate Planners Toolkit Mcnamara Yates P C

What Is The Estate Tax In Massachusetts Massachusetts Probate Law Mcnamara Yates P C

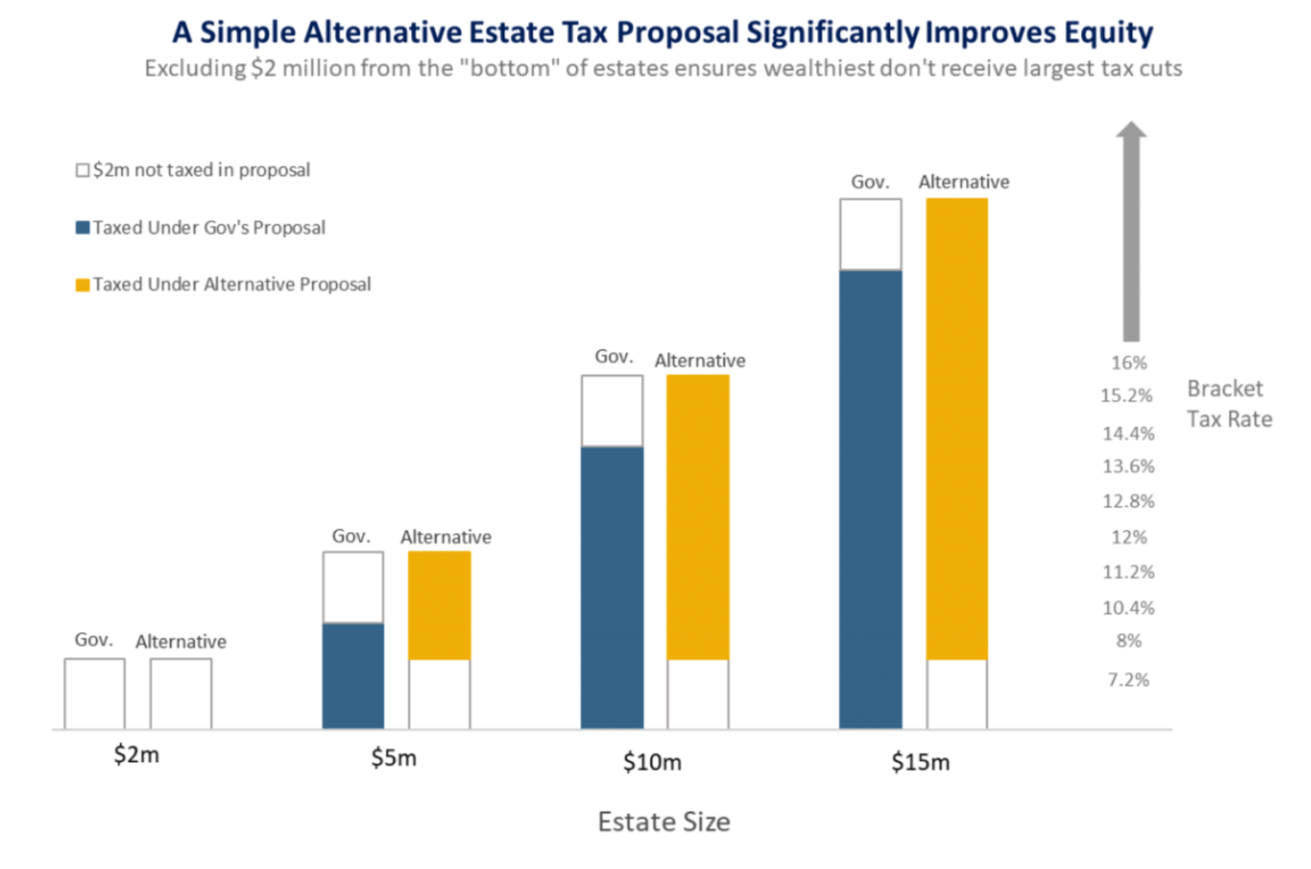

Current Estate Tax Proposals Would Give Largest Benefits To Wealthiest Estates Alternative Method Would Fix This Problem Mass Budget And Policy Center

Massachusetts Estate And Gift Taxes Explained Wealth Management

Massachusetts Tax Relief Senate Unveils Changes To Estate Tax Plus Child Care Credit And Rental Deduction Cap Among Other Cuts Masslive Com

Ma Estate Tax You Re Richer Than You Think Slnlaw

Death And Taxes Front And Center In Massachusetts